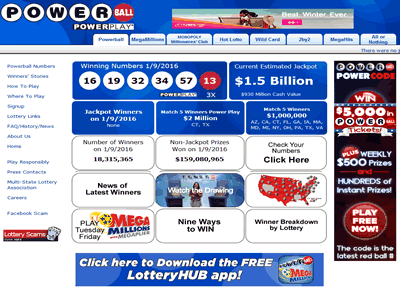

With the current Powerball Jackpot reaching historic figures, likely topping out at over $1.5 Billion, there is a lot of discussion going on about the winning odds, life changing dreams and of course, taxes. Everyone understands that even if you are the sole winner in this week’s Powerball drawing, you are not going to walk away with the full jackpot. So what will your winning share look like after the tax bill clears? We’ve broken it down for you to give you an idea of whether or not you can live with what is left over, and we’re guessing that will be a great big resounding yes.

What is My Take Home if I Win the Powerball Jackpot?

The odds for winning the enormous Powerball jackpot stand at one in 292.2 million. If you are fortunate enough to be the sole winner (a 22% chance), and opt for the incremental 30 payments spread over 29 years, your prize will be the estimated $1.5 billion (before taxes). If you prefer the lump sum option, then your jackpot prize is reduced to $930 million (before taxes). The lump sum jackpot reduction is a 38% cut that takes place before the tax bill is applied. But $930 million is nothing to sneeze at! I don’t anyone personally whose life would not be changed by that. But lets take a look at how the tax bill will affect that figure.

What Taxes Do I Have to Pay if I Win the Powerball Jackpot?

The first cut will come with the federal tax bill. Your winnings will be considered traditional income and will be taxed accordingly. Due to the size of the prize, the hghest tax rate of 39.% will be applied. This is not the type of situation which elicits tax breaks from the government, so don’t expect any work arounds here.

The federal tax bill is applied in a two step process. First, the feds will automatically withhold 25% for US residents who hold a legitimate social security number. Take home winnings will be reduced by a sizeable $232.5 million, still leaving the winner(s) plenty of multi-million dollar stacks of money. Residents without social security numbers will pay a little bit steeper 28% and non-residents will face a 30% automatic withholding.

The second step in the federal income tax process for the jackpot prize will be paid in April at a rate of 14.6%. This comes out to an additional $135.8 million reduction to your jackpot winnings. Since this bill will come due long after your life changing win is paid out, you want to make sure you budget for it. After all federal taxes are applied and paid, you will still be left with a whopping $561.7 million in winnings! Again – nothing to sneeze at. That is undeniably a payout that can dramatically change the lives of yourself, everyone you love and everyone you ever wanted to help.

If you live in a state in which you are subject to state and local taxes, this could also impact your winnings, up to another 15% in fact – which could shave off another $139.5 million off your prize, leaving you with approximately $422.2 million in prize money. The lucky winner will live in a state without state that participates in Powerball but that does not have a state income tax, such as Florida or Texas, among others. There are also a few states that participate in the lottery drawing but that don’t apply a state income tax if the ticket was purchased in state. California and Pennsylvania have this type of exemption for lottery winnings.

Giving Money Away Could Cost you More Taxes

If you are sharing your jackpot, be sure to have agreements in place before you win so that you are not stuck with the whole tax bill from the prize and even gift taxes on top of that for sharing the prize. There are limits to how much you may gift others (spouse exempted) without paying a hefty tax penalty for doing so. This is worth researching ahead of time so you can avoid the flat 40% gift tax for exceeding those limits.

Ways to Shave Off Some of the Sting from your Tax Bill

Giving to charity will allow you to some additional deductions to your taxes while also helping others. There are some great exemptions in place and policies that allow you to claim donations worth up to 50% of your adjusted income – and even carry over the excess of that limit for up to five years. Not a bad little perk. You can also deduct gambling loses up to the amount of your winnings as long as you can document the purchases. Consulting with a tax planner can provide you with the best strategy for not avoiding extravagant tax penalties.

Is it Still Worth Playing?

We always feel Uncle Sam and Washington DC in our pockets, but we don’t stop working and trying to make a life for ourselves. This amazing jackpot prize is no different. Even with the worst-case scenario that includes federal, state and local taxes, you still are walking away with a sizeable, multi-million dollar prize that will ensure your life is forever changed, and hopefully in a way you never imagined. Don’t fret about the tax bite – as the sole winner, you’ll have about $422.2 million reasons to take your mind off it. And if you end up sharing the prize with other winners, your tax bill will be smaller too – so either way, you come out pretty well set in the end.

Check out our legal online lottery guide for insight to buying your tickets online and what legal considerations should be taken into account.